Think of brand health tracking as a continuous check-up on how people really feel about your brand. It’s not just about what you sell, but about what your brand means to your audience. This process gives you an ongoing report card on consumer perception and how you stack up against the competition, moving way beyond simple sales figures to uncover your true strengths and weaknesses.

It’s like having a vital signs monitor hooked up to your brand’s reputation.

Why Brand Health Tracking Matters Now More Than Ever

If you're only looking at revenue to gauge your success, you're driving by looking in the rearview mirror. Sales data is great for telling you where you've been, but brand health tracking is your GPS, showing you where you're headed. It acts as a kind of forward-facing sonar, picking up on subtle shifts in customer sentiment, loyalty, and awareness long before they ever show up on your balance sheet.

This kind of proactive insight is non-negotiable today. Perceptions can change in an instant. A single viral TikTok, a smart campaign from a competitor, or a sudden cultural shift can redefine your brand's standing overnight. Flying blind without a system to monitor these changes means you’re making critical business decisions based on guesswork, not evidence.

Moving Beyond Lagging Indicators

Metrics like sales, web traffic, and follower counts are lagging indicators—they report on things that have already happened. Brand health metrics, on the other hand, are leading indicators. They give you a glimpse into the future.

- Anticipate Market Shifts: By keeping an eye on sentiment, you can spot what consumers are getting excited about (or frustrated with) and pivot your strategy before everyone else does.

- Neutralize Competitive Threats: Tracking your "share of voice" tells you when a competitor is starting to make noise, giving you a chance to react before you start losing ground.

- Strengthen Customer Loyalty: Monitoring metrics like your Net Promoter Score (NPS) helps you pinpoint what makes your loyal customers tick—and where you can make the experience even better.

Grounding Strategy in Reality

Brand health tracking has grown from a simple marketing chore into a core business function. It’s about collecting data consistently to understand the ever-shifting landscape of consumer trust. This constant monitoring allows a company to spot a dip in brand trust before it hits sales figures or to manage a PR crisis with actual data.

In fact, industry analysis reveals that 70% of marketers now consider brand health tracking essential for making smarter decisions. It allows leadership to build strategies on real-time consumer insights instead of just gut feelings. You can dig deeper into the competitive advantage this offers in this detailed brand health analysis.

Ultimately, brand health tracking is about managing risk and spotting opportunities. It turns your brand from a static logo into a living, breathing entity that you can guide, nurture, and grow with real confidence.

By consistently measuring how your audience sees you, you’re building a more resilient and adaptable business. You get the clarity to invest your resources wisely, sharpen your messaging, and build real relationships with customers who don't just buy from you, but truly believe in you. This is how your brand doesn’t just survive market turbulence—it thrives in it.

Understanding the Pillars of Brand Health

To really get a handle on brand health tracking, you have to stop thinking of "brand health" as one big, fuzzy concept. It’s not. A better way to look at it is like a sturdy building held up by four distinct pillars. Each one is critical, and if even one starts to wobble, the whole structure is at risk.

This framework gives you a clear way to measure what’s working and what isn’t. By breaking your brand’s health down into these core components, you can pinpoint specific problems, celebrate your strengths, and finally see how all the pieces fit together to shape your presence in the market.

Pillar 1: Brand Awareness

The first and most foundational pillar is Brand Awareness. At its core, it answers a simple question: "Do people even know we exist?" If your brand were a shop on a busy street, awareness is how visible your storefront is. Without it, nothing else really matters—you can't build a reputation or earn loyalty if you're invisible.

But awareness is more than just people recognizing your logo. It’s about being top-of-mind when a potential customer has a problem you can solve. This is where every single customer relationship begins, making it the non-negotiable starting point for any health check.

How well a brand is recognized is one of the clearest signs of its health. For example, a 2023 study found that McDonald's 'Golden Arches' were identified by a staggering 94% of people. As detailed in this Sprinklr report, that kind of reach is the result of decades of consistent branding. Without that initial spark of recognition, none of the other pillars can even begin to form.

Pillar 2: Brand Perception

Okay, so people know who you are. The next question is a bit more personal: "What do they think of you?" This is Brand Perception, and it’s all about your reputation in the neighborhood. It’s shaped by every single touchpoint a customer has with your brand—from your ads and social media to your customer service and the quality of your product.

Here’s the thing about perception: it’s entirely in the hands of your audience. You can influence it, for sure, but you don't own it. It’s the collective feeling, the sum of all experiences that decides whether people see you as reliable, innovative, a great value, or completely out-of-touch. Managing this consistently is crucial, and our guide to creating strong brand social media guidelines can help you keep that image positive.

Pillar 3: Brand Loyalty

Awareness gets them in the door, and perception shapes their first impression. But Brand Loyalty is what keeps them coming back for more. Think of these customers as your regulars—the people who choose you over and over, even when a competitor is dangling a tempting discount.

Loyalty isn't accidental; it's earned through consistently positive experiences. It’s what turns a one-time buyer into a repeat customer and, eventually, into someone who raves about you to their friends. This pillar measures the strength and staying power of your customer relationships.

A loyal customer base is an absolute powerhouse for a business. It provides a stable stream of revenue, slashes customer acquisition costs, and acts as a buffer when the market gets shaky.

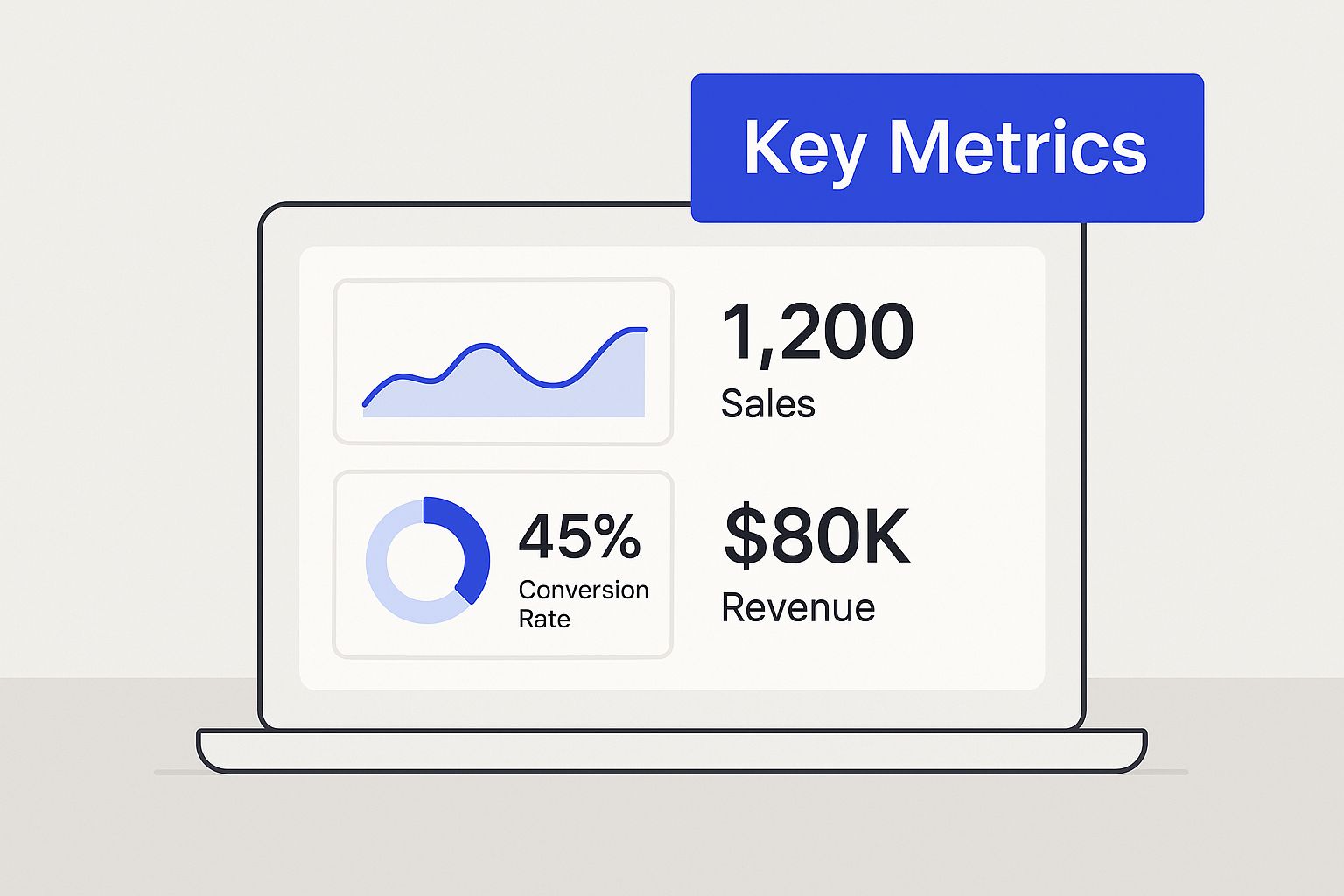

To keep tabs on these pillars, marketers often use dashboards that bring key metrics together in one place.

This kind of visualization helps show how different data points connect to paint a complete picture of your brand's performance.

Pillar 4: Brand Equity

Last but not least, we have Brand Equity. This is the grand total, the culmination of the other three pillars. It represents the commercial value your brand name holds all on its own—the influence, trust, and market power you've built up over time.

With strong brand equity, you can command higher prices, launch new products with a built-in audience, and bounce back from a PR stumble much faster than a lesser-known competitor.

Think of it as the goodwill and trust you’ve deposited into a "reputation bank." A brand with sky-high equity, like Apple or Nike, has a massive competitive advantage simply because its name alone carries so much weight and consumer confidence. Each pillar builds on the last, creating a powerful foundation for long-term, sustainable growth.

To bring it all together, here’s a simple table breaking down what each pillar really means for your business.

The Four Pillars of Brand Health Explained

| Pillar | What It Measures | Why It Matters | Key Question to Ask |

|---|---|---|---|

| Brand Awareness | How familiar your target audience is with your brand. | You can't be chosen if you're not known. It's the top of the funnel. | "Do people in our target market know who we are?" |

| Brand Perception | The associations, feelings, and beliefs people have about you. | This is your reputation. It dictates whether customers see you as a solution. | "What do people think and feel when they hear our name?" |

| Brand Loyalty | The likelihood of customers choosing you again and again. | It creates stable revenue, reduces marketing costs, and builds advocates. | "Are our customers sticking with us, or are they easily swayed?" |

| Brand Equity | The overall commercial value derived from consumer perception. | It's your competitive moat—allowing for premium pricing and resilience. | "How much is our brand name actually worth in the market?" |

By systematically tracking these four areas, you move from guessing about your brand's performance to truly understanding it.

Alright, you know what brand health is, but how do you actually put a number on it? This is where we move from fuzzy concepts to cold, hard data—the kind that tells you if you're winning or just spinning your wheels.

This isn't about chasing vanity metrics. It’s about picking specific, meaningful KPIs that tie directly back to your business goals.

Think of it like a pilot flying a plane. They don't just stare at the altitude dial. They're constantly checking speed, fuel levels, and the compass to get the full picture. Your brand health dashboard needs that same holistic view, with each metric telling a crucial part of your story.

Gauging Loyalty and Customer Sentiment

One of the best signals of a healthy brand? Customer loyalty. These are the people who form the foundation of your growth, and figuring out how they really feel gives you an unfiltered look at what’s working and what isn't.

The Net Promoter Score (NPS) is a classic for a reason. It all boils down to one simple but powerful question: "On a scale of 0-10, how likely are you to recommend our brand to a friend?"

This one question neatly sorts your customers into three camps:

- Promoters (9-10): These are your die-hard fans. They're out there creating positive word-of-mouth for you, for free.

- Passives (7-8): They're happy enough, but they aren't raving. They could easily be swayed by a competitor's shiny new offer.

- Detractors (0-6): These are the unhappy campers. They're at risk of not only leaving but also telling others about their bad experience.

To get your score, you just subtract the percentage of Detractors from the percentage of Promoters. A high score is a fantastic predictor of growth and retention. Of course, gathering this data effectively means using the right customer satisfaction measurement tools to get an accurate read.

Measuring Visibility in a Crowded Market

In today's noisy world, just showing up isn't enough. You need to know how much of the conversation you actually own. That's where Share of Voice (SOV) comes into play.

SOV is your brand's visibility compared to your competitors. It's the slice of the industry conversation that belongs to you.

While it was traditionally measured by ad spend, today's SOV is much better tracked by monitoring online mentions across social media, blogs, and news sites. If your SOV is climbing, it's a great sign your marketing and PR are cutting through the static. You can get into the weeds of tracking these mentions in our guide to social media analytics and reporting.

Share of Voice isn’t just about being the loudest; it’s about understanding who is dominating the conversation and why. It provides critical context for your brand awareness efforts.

Analyzing Public Perception with Sentiment Analysis

While SOV tells you if people are talking about you, Sentiment Analysis tells you how they feel when they do. This tech scans online conversations and flags them as positive, negative, or neutral.

It’s an incredible real-time pulse check on public perception. A sudden spike in negative sentiment can be the canary in the coal mine for a product flaw or a PR crisis, giving you a head start to get things under control.

On the flip side, a wave of positive chatter highlights exactly what you're doing right. It gives you a goldmine of testimonials and social proof to amplify in your marketing.

Building Your Core Metrics Dashboard

To make any of this useful, you need a central dashboard that pulls these key metrics together. A great dashboard doesn't just show you numbers; it tells a story.

Here are a few essential KPIs to get you started:

- Brand Recall and Awareness: How easily do people think of your brand? You can measure this with surveys asking consumers to name brands in your space (unaided recall) or pick yours from a list (aided recall).

- Purchase Intent: This is all about gauging how likely someone is to choose you for their next purchase. It's a forward-looking metric that's often captured through targeted surveys.

- Customer Lifetime Value (CLV): This number predicts the total revenue you can expect from a single customer over time. It's a massive indicator of long-term brand health.

- Brand Associations: What words or feelings do people connect with your brand? Think "innovative," "reliable," or even "expensive." Understanding these connections is key to shaping your brand's identity.

By keeping a close eye on these metrics, you're officially moving beyond guesswork. You’re building a clear, data-backed understanding of your brand's place in the world and what you need to do to make it even stronger.

Choosing the Right Tracking Approach

Once you've figured out what to measure, the next big question is how you'll actually get the data. There’s no single "right way" to do brand health tracking. The best approach for you will depend entirely on your goals, your budget, and how fast you need information to make smart decisions.

Think of it like monitoring your own health. Sometimes, you need a full annual physical—a deep dive that gives you a detailed snapshot at one specific moment. Other times, you need a live heart rate monitor during a workout, giving you a constant stream of real-time data so you can adjust your pace on the fly.

These two ideas perfectly mirror the main ways brands track their health: periodic snapshots and continuous monitoring.

Periodic Surveys: The Annual Checkup

The traditional way to track brand health is through periodic surveys, which work a lot like that yearly doctor’s visit. You conduct large-scale surveys at set times—maybe quarterly, twice a year, or annually—to get a deep, comprehensive look at where your brand stands.

These surveys are fantastic for setting a detailed baseline and understanding the big picture. They let you ask in-depth questions about perception, loyalty, and awareness, giving you the rich, qualitative "why" behind the numbers that raw data often misses.

The downside? Their infrequency creates blind spots. A lot can happen between surveys. A competitor could launch a massive campaign or a negative story could go viral, and you wouldn't have the data to see the impact until your next scheduled check-in months later.

Continuous Tracking: The Live Heart Monitor

Continuous tracking is the more modern alternative, acting like that live heart rate monitor for your brand. This method pulls in a constant stream of data from sources like social media listening, online review monitoring, and smaller, ongoing "pulse" surveys. It gives you a real-time view of your brand’s health.

The biggest advantage here is speed. You can spot a spike in negative sentiment within hours, not months, letting you react quickly before a small problem becomes a full-blown crisis. Continuous tracking is perfect for measuring the immediate impact of a new marketing campaign and staying agile in a fast-moving market. A great way to keep tabs on all this information is by setting up effective social media analytics dashboards that pull all these streams into one place.

The trade-off, however, can be depth. While you get immediate data, it might not give you the detailed context that a comprehensive survey provides.

Choosing a method isn’t about picking the "best" one. It's about picking the one that aligns with your strategy. If you're in a volatile industry with frequent product launches, continuous tracking is a must. If you’re a stable brand focused on long-term growth, periodic surveys might be all you need.

Finding the Best of Both Worlds: The Hybrid Approach

For most businesses, the ideal solution isn't an either/or choice. A hybrid approach combines the strengths of both methods, painting the most complete picture of your brand's health.

This approach uses continuous tracking for day-to-day monitoring while layering in periodic deep-dive surveys for strategic insights.

- Continuous Social Listening: To keep a finger on the pulse of daily conversations and sentiment.

- Ongoing Pulse Surveys: Short, frequent surveys to track key metrics like NPS over time.

- Annual Deep-Dive Study: A comprehensive survey to explore brand perception, competitive positioning, and strategic insights in detail.

This integrated system gives you the early-warning capabilities of a live monitor and the diagnostic depth of a full checkup. You'll never miss a critical shift in perception, but you'll still gather the rich data needed for smart, long-term planning.

To help you decide which path is right for you, here’s a quick comparison of the two core approaches.

Comparing Brand Tracking Methodologies

An overview of the two main brand health tracking methods, highlighting their key differences to help businesses choose the right approach for their needs.

| Feature | Continuous Longitudinal Tracking | Periodic Snapshot Surveys |

|---|---|---|

| Frequency | Real-time or daily data collection. | Conducted at set intervals (e.g., quarterly, annually). |

| Insight Speed | Immediate. Excellent for spotting trends as they happen. | Delayed. Insights are only available after each survey period. |

| Data Depth | Often focused on key quantitative metrics like sentiment. | Provides deep qualitative and quantitative insights. |

| Best For | Agile marketing, crisis management, campaign tracking. | Strategic planning, deep competitive analysis, establishing baselines. |

| Cost | Can have higher ongoing software and personnel costs. | Higher upfront cost per survey but predictable budgeting. |

In the end, selecting your brand health tracking strategy is a major strategic decision. By weighing the speed, depth, and cost of each approach against your specific business goals, you can build a system that delivers the actionable insights you need to protect and grow your brand.

Building Your Brand Health Tracking Program

Alright, we’ve covered the "what" and the "why." Now it's time to roll up our sleeves and get into the "how." Setting up a formal brand health tracking program can feel like a massive undertaking, but it really just boils down to a methodical, step-by-step process.

Think of it as building a reliable feedback loop for your brand. You need a system that constantly tells you where you stand with your audience, so you can stop guessing and start making smart, data-backed decisions. Let’s walk through the essential steps to get your program off the ground.

Step 1: Define Your Core Objectives

Before you even glance at a metric or a tool, you have to answer the most important question of all: "What are we actually trying to achieve here?" Your objectives are your North Star. They guide every single decision you'll make from this point forward.

A vague goal like "improve brand health" just won't cut it. You need to get specific and tie your objectives to real business outcomes.

- Trying to Increase Market Share? If you’re a challenger brand trying to muscle in on the big players, your focus will be on awareness and competitive Share of Voice (SOV).

- Need to Boost Customer Loyalty? If your main goal is to stop churn and get more repeat business, you'll be zeroing in on metrics like NPS and Customer Lifetime Value.

- Have to Justify Marketing Spend? Need to prove that big campaign was worth it? Tracking sentiment and purchase intent before and after will be your saving grace.

Nailing down these goals ensures the data you collect isn't just "interesting"—it's actionable.

Step 2: Select Your Key Performance Indicators

With clear objectives in hand, now you can pick the specific KPIs that will actually measure your progress. It's incredibly easy to get lost in a sea of data, so don't try to measure everything. Just measure what matters.

For example, if your big objective is to become the most trusted name in your industry, your dashboard should be built around metrics like:

- Net Promoter Score (NPS): A direct line into customer satisfaction and their willingness to recommend you.

- Sentiment Analysis: To get a feel for the emotional tone of conversations happening about your brand online.

- Brand Association Surveys: To see if people connect your brand with words like "reliable," "quality," or "trustworthy."

This focused approach keeps you from getting overwhelmed and ensures your team is locked in on the numbers that truly move the needle for your business.

Step 3: Choose Your Tools and Methodologies

Time to figure out how you’re going to collect all this great data. The tools and methods you choose will hinge on your budget, team size, and the tracking cadence you decided on earlier (continuous, periodic, or a hybrid).

A crucial piece of the puzzle is bringing all your data together. Implementing effective customer data integration solutions is key to unifying information from different sources into one coherent picture.

The right tool isn't always the flashiest or most expensive one. It's the one that gives you the specific data you need in a way your team can easily understand and act on.

Modern platforms are great at pulling multiple data streams into a single dashboard. In fact, 54% of organizations now use tech that can analyze customer sentiment from both social media and reviews at the same time. That unified view is priceless.

Step 4: Establish a Baseline

This is a step people often forget, but it’s critical. You can't know if you're making progress if you don't know where you started. Before you officially launch your program, you need to establish a baseline.

This means doing a comprehensive, initial measurement of all the KPIs you just selected. This first data pull creates the benchmark that all your future efforts will be measured against.

Think of it as your "Day One" snapshot. It shows you exactly where you stand right now in terms of awareness, perception, and loyalty. From here on out, every new report gains meaning because you can see how things have changed from that starting point. It’s the only real way to know if your strategies are working.

Turning Brand Data into Strategic Action

Collecting brand health data is a lot like gathering ingredients for a meal; the real magic doesn't happen until you actually start cooking. A rising NPS score or a dip in sentiment is, on its own, just a number. The true power of brand health tracking is unlocked when you translate that raw data into clear, strategic decisions that actually grow the business.

This isn't about getting lost in complex statistical analysis. It’s about connecting the dots. It’s about spotting patterns, constantly asking "why," and weaving your findings into a story that gets people to act. Without this final step, your data is just noise—interesting, maybe, but totally useless for steering the ship.

From Observation to Insight

First things first, you have to move beyond just reporting numbers and start diagnosing the reasons behind them. This means looking at your metrics in context. A sudden drop in brand sentiment isn't just a data point; it’s a symptom, and you need to find the cause.

The best way to do this is by mashing different data sources together. For example:

- Did your NPS score jump last month? Pull up your product release schedule. Maybe that spike lines up perfectly with a new feature launch, giving you solid proof that your development roadmap is on the right track.

- Is your Share of Voice shrinking? Overlay that data with a competitor analysis. You might discover a rival just launched a massive ad campaign, which means you need to decide how to respond.

- Seeing a spike in negative mentions? Filter those conversations by keyword. You could find they all circle back to a specific customer service snag, giving you a crystal-clear problem to solve.

This approach turns you from a data reporter into a data detective, finding the real story hidden in the numbers.

Storytelling with Data for Leadership

Once you've got an insight, you have to sell it. A spreadsheet full of percentages isn't going to inspire anyone to change course, but a clear, compelling narrative will. You need to frame your findings as a story with a clear beginning, middle, and end.

Data tells you what is happening, but a story tells you why it matters. Presenting your brand health findings as a narrative is the most effective way to secure buy-in for strategic initiatives and demonstrate a clear return on investment.

So, instead of saying, "Our brand sentiment dropped by 8%," try this:

"Last quarter, a key competitor launched their 'Eco-Friendly' campaign, and our sentiment score among environmentally conscious consumers dropped by 8%. At the same time, their Share of Voice on this topic shot up by 15%. This tells us we're losing ground on a core value proposition and need to launch a counter-campaign to reclaim our position."

See the difference? This version provides context, identifies a threat, and points directly to a solution.

Building a Framework for Action

To make this process second nature, create a simple framework for your team to follow every time they dive into brand health data. This keeps everyone on the same page and makes sure no insight ever falls through the cracks.

- Identify the Signal: What's the most significant change in the data this period? (e.g., A 5-point drop in NPS).

- Investigate the Cause: What internal or external factors could be behind it? (e.g., A recent price increase or a competitor's big sale).

- Define the Implication: What's the business risk or opportunity here? (e.g., Potential customer churn or a chance to highlight our superior value).

- Recommend the Action: What specific, measurable step should we take next? (e.g., Launch a targeted email campaign to high-value customers explaining the price change).

By using a simple framework like this, you turn brand health tracking from a passive reporting task into a powerful engine for strategic growth.

Here are some of the most common questions that come up when brands first start digging into health tracking.

How Often Should We Be Doing This?

There’s no one-size-fits-all answer here. The right cadence really depends on your market and what you’re trying to achieve.

If you're in a fast-moving industry or in the middle of a big campaign launch, you’ll want continuous, real-time tracking to get immediate feedback. For more established brands with a focus on long-term growth, a deep-dive survey every quarter or even twice a year can be plenty.

A lot of businesses find success with a hybrid approach—keeping an ear to the ground with constant social listening while scheduling those more in-depth analyses periodically.

What's the Single Biggest Mistake to Avoid?

Easy. The biggest mistake is tracking metrics just for the sake of tracking them.

Collecting a mountain of data that just sits on a dashboard doesn't help anyone. You need to make sure every single KPI is tied to a real business goal. Have a game plan for how you'll turn those insights into actual decisions.

Without a strategy, data is just noise.

A great brand health program isn't measured by how much data you collect. It's measured by the quality of the decisions you make because of that data. Every insight should lead to a tangible, strategic action.

Can a Small Business Even Afford This?

Absolutely. It’s a common misconception that this is only for the big players with massive budgets.

While some enterprise-level platforms can be pricey, there are plenty of affordable tools out there perfect for small businesses. You can start simple by monitoring your social media sentiment, sending out basic NPS surveys, or just keeping a close eye on your Google Reviews.

Brand health tracking is scalable. Start with the foundational metrics that matter most to you, and you can always expand the program as your business grows.

Ready to stop guessing and start making data-driven decisions about your brand's reputation? PostSyncer gives you all the tools you need to monitor social sentiment, track key metrics, and analyze your performance in one place. Start your free 7-day trial and see what real-time brand insights can do for you.